Successful Retirement Starts With A Retirement Preparation Checklist

Successful Retirement Starts With A Retirement Preparation Checklist

Blog Article

I think that we have all the same dream. That dream is to be rich - rich enough without requiring to work to offer all of our requirements, without being a slave to money and without worry of not having enough. Well, aren't we dreaming about retirement? Yes! Retirement is everything about living well without working. You can work if you like it, however you do not need to require yourself.

Step # 6: Stock Your Insurance coverage. While there are lots of kinds of insurance the type we are interested in here are life, medical, impairment and long-term care.

My personal motto is "retire with a function. or simply start to pass away." I think that at this phase of life it is extremely important to have a significant purpose. Most of the times we are unprepared. Bur accept that for most of retirees It's not going to be easy and there are great reasons for the saying "old age is not for sissies".

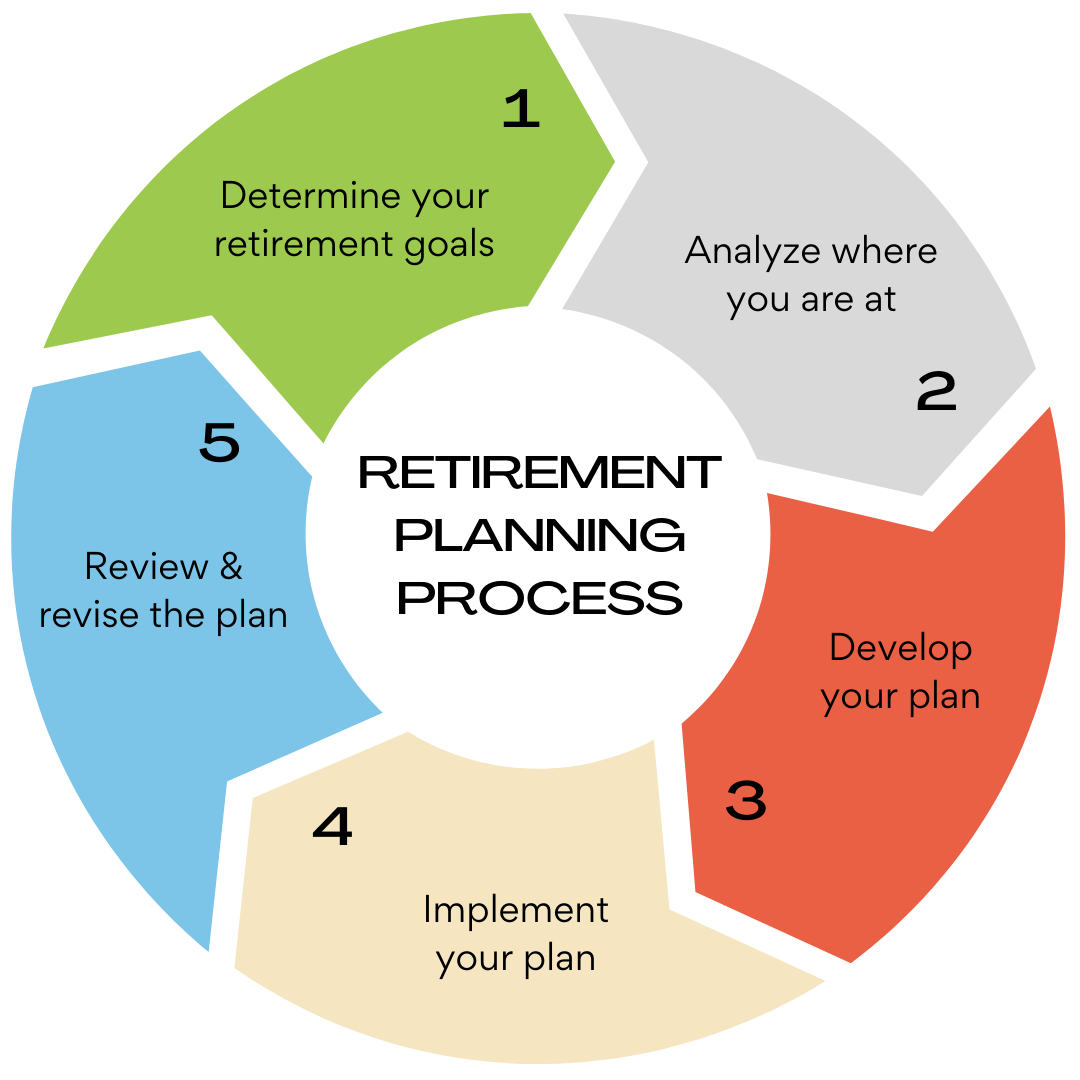

Lastly, the cook interested in making certain the meal comes out as planned, will taste along the method. In terms of retirement planning, this is the monitor and adjust-as-needed part of the procedure. Offered the number of years over which we will typically handle financial investments for retirement, it is crucial to remain watchful and on top of the process so that we attain the result we seek. We can use the unpredictability, in addition to our vision, to keep us motivated.

Step # 5: Round up all your assets. Possessions you'll wish to list here include your home, financial investment residential or commercial properties, retirement investments (401k, IRA, etc), annuities, pensions, stocks & bonds, antiques (paintings, coins, comic books, and so on), cost savings (cash, CDs, Treasury Costs, etc) and other prized possessions.

Part of getting to where you want to be in your retirement planning is in fact making a plan. If you have a plan currently, then you might need to make a much better plan. A better strategy will include you concerning grips with the reality that you do not have all the responses and perhaps even swallowing your pride just a bit to guarantee that your retirement preparation is all that it should be.

For e.g. Mr. X and Mr. Y both wish to retire at 55 years of age. retirement planning Mr. X begins investing when he is 25 years of age. So he has thirty years to construct his retirement corpus. Even if he invests just Rs.5000 p.m. in equity mutual fund that offers him 15% return p.a. his money can grow to Rs.2.82 cr at the end of 30th year.

The danger of not having a strategy will require the retirees to work till they pass away or live in poverty. They might outlive their money at retirement. Those who enter in this endeavor with minimal funds can be since of bad financial investment decisions or there is a lack of investment recommendations.